How to make cost estimation for construting a building?

TweetEstimating has taken on a new significance in today's competitive construction marketplace.From the time a construction project is proposed, and throughout its life, the estimate provides information that is critical to its success. Therefore estimation is essential to the execution of all work and for maintaining project control.

The key to producing an accurate estimate lies in the organization of the information that will be used to determine the amount of material, labour, and equipment required for the project. Based on this information, the estimator can apply prices, contingencies, and then profit.

The estimating process does not end here. Once the project is awarded and the work begins, the original estimate will be revisited over and over again. It will be reviewed, referred to, praised, criticized, second-guessed, and, yes, even cursed as the project progresses. And in the end, it will be put to the final test of profitable or not.

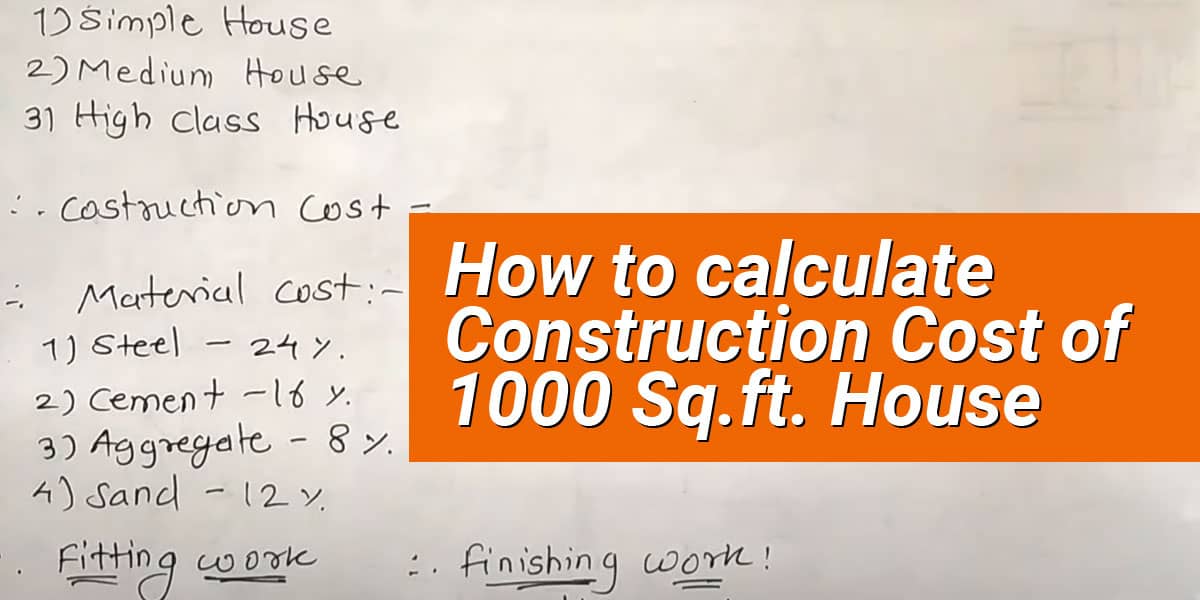

There are two important modifier in estimating the cost of construction; material and labour cost. Let's first understand what is material cost?

UNDERSTANDING MATERIAL COST

Two modifiers are added to the costs of materials to arrive at an accurate price: taxes and waste. Some taxpayer- and government-funded projects are exempt from taxes, so there may be no need to add it. However, most residential and commercial projects are subjected to tax on materials.

Waste is applicable to most materials for several different reasons. Properly accounting for waste is often a matter of judgment based on experience. It would be impossible to predict which materials will incur more waste, so the most practical approach is to add a percentage in rupees to the lump sum quote.

Click on the below link for better understanding of material cost

UNDERSTANDING LABOUR COST:

Calculating the cost of labour unit prices is more difficult than for material unit prices. The following modifiers given below will help us to determine the price of each labour.

- WAGE RATE:

The term wage rate for this discussion refers to the agreed-upon wage between the employee and employer. The wage rate, or the hourly rate of pay on which the employee's pay

- BENEFITS:

Many employers provide benefits in the form of medical, vacation pay, paid sick days, retirement package contributions, annuities, or a variety of other compensatory benefits. The costs of these benefits are typically included within the calculation of the burdened rate. These benefits represent a cost to the employer that must be recovered, which can be broken down into a percentage of the hourly rate and then extended to a rupees amount per hour. This rupees amount is then added to the wage rate.

- INDIRECT OVERHEADS:

Costs related to the operation of the main office and its staff are indirect overhead expenses. These costs, are associated with maintaining a business, but are not directly attributable to a specific project. Indirect overhead includes, but is not limited to, expenses such as:

- Corporate officers' salaries and benefits

- Rent or mortgage for the main office

- Monthly telephone, fax, or Internet charges

- Clerical and office associates' salaries, insurance, and taxes

- Corporate vehicles, insurance, and maintenance/operating costs

- Heating, electricity, and maintenance of the main office

- PROFIT:

Profit is the reason for doing business. It is the end result of a project done right and/or the reward for risks taken. Profit is most often assigned as a percentage of all costs of the work. However, it can be assigned as a lump sum or stipulated fee. Calculating profit is based on careful consideration of a host of factors—some less tangible than others.

check calculated, is regulated by the agreement between the employee and the employer, a collective bargaining agreement, or by a prevailing wage rate.

Click on the below link for better understanding of labour cost